XRP Price Prediction: Will the Cross-Border Asset Break $5 in 2025?

#XRP

- Technical Outlook: Mixed signals with MACD bullish but price below key MA

- Regulatory Catalyst: Ripple vs SEC conclusion may trigger 20%+ volatility

- Adoption Trend: Korean institutional interest could drive demand

XRP Price Prediction

XRP Technical Analysis: Key Indicators to Watch

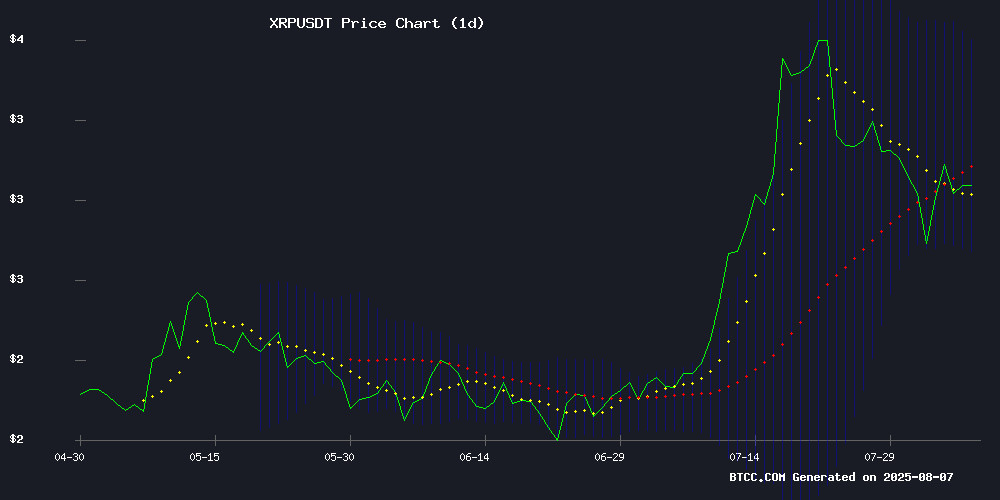

According to BTCC financial analyst James, XRP is currently trading at 2.9748 USDT, below its 20-day moving average (MA) of 3.1452, indicating potential short-term bearish pressure. The MACD (12,26,9) shows a positive momentum with values at 0.2061 (MACD line), 0.0404 (signal line), and 0.1657 (histogram). Bollinger Bands suggest a range-bound market with upper, middle, and lower bands at 3.5540, 3.1452, and 2.7364 respectively. A break above the 20-day MA could signal a bullish reversal, while failure to hold above the lower band may intensify selling pressure.

XRP Market Sentiment: Mixed Signals Amid Volatility

BTCC financial analyst James notes that XRP's price action reflects market uncertainty, with headlines highlighting both bullish and bearish catalysts. Institutional support in South Korea and the Ripple vs SEC case nearing conclusion could provide upside, while trader rotation into altcoins and cloud mining shifts may cap gains. The $3 level remains a key psychological barrier, with volatility expected until clearer regulatory or institutional trends emerge.

Factors Influencing XRP’s Price

XRP Eyes $5 Amid Market Volatility as New DeFi Project Gains Traction

XRP's price trajectory remains a focal point for traders despite recent declines, with analysts maintaining bullish targets near $5 in August. Technical patterns suggest a potential rebound from current levels around $3.05, though on-chain data indicates critical support lies between $2.48-$2.80.

Meanwhile, Remittix emerges as a disruptive force in cross-border payments, leveraging scalable DeFi infrastructure. The project's upcoming beta wallet launch and CertiK audit position it as an institutional-grade alternative to legacy solutions.

Ripple (XRP) Gains Institutional Support in South Korea Amid Cloud Mining Boom

Ripple's XRP has secured a strategic foothold in South Korea's financial ecosystem. The Korea Digital Finance Agency (KDFA) has officially designated RippleNet technology as a preferred blockchain payment solution, marking a significant milestone for institutional adoption in Asia's crypto-friendly markets.

Concurrent with this regulatory win, XRP holders are capitalizing on new income streams. Rich Miner, a global cloud mining platform, now enables users to generate up to $4,500 daily from their XRP holdings—transforming passive assets into active revenue generators.

The dual developments underscore XRP's growing utility. Ripple's payment protocol, long praised for its efficiency, gains further legitimacy through Korean institutional endorsement. Meanwhile, the cloud mining opportunity addresses investor demand for yield-bearing crypto applications.

XRPScan Integrates Midnight Glacier Drop Eligibility Check for XRP Holders

XRPScan, a leading explorer for the XRP Ledger, has added a feature allowing XRP holders to verify their eligibility for the Midnight Glacier Drop. Users can now check their status directly on the platform by entering their wallet address and navigating to the airdrop tab.

Eligible participants—those holding at least $100 worth of XRP as of June 11—can claim NIGHT tokens, with XRP addresses allocated 2.623 billion tokens, or 10.92% of the total supply. The move follows the launch of the Glacier Drop claim portal, positioning XRP as one of eight supported blockchains for the distribution.

Institutional Crypto M&A Gains Momentum Amid Policy Shifts and Market Evolution

The financial services industry stands at an inflection point as blockchain-based digital assets transition from niche instruments to core components of global capital markets. With a total cryptocurrency market capitalization nearing $3.8 trillion—comparable to a segment of the MSCI World Index—the sector demonstrates outsized growth potential against traditional finance's $128 trillion equity market.

Strategic mergers and acquisitions underscore this transformation. Notable deals include Kraken's $1.5 billion NinjaTrader acquisition to bolster trading infrastructure and JPMorgan Chase's integration with Coinbase wallets, bridging traditional banking with crypto liquidity. Private equity firms like Carlyle and Bain Capital are deploying capital to capture sector exposure, with Bain's $2.1 billion Acrisure purchase highlighting institutional appetite for blockchain-adjacent assets.

Cross-border transactions further signal maturation, as regulatory clarity and technological innovation converge. The pipeline remains robust following Circle's and eToro's public listings, with exchange operators like Coinbase pursuing strategic alliances to expand derivatives access through deals such as its $2.9 billion Derebit partnership.

Ripple vs SEC: Final Stage of Appeals Process Nears Conclusion

The protracted legal battle between Ripple and the U.S. Securities and Exchange Commission is approaching a critical juncture. Attorney Bill Morgan confirms both parties are in the final phase of the appeals process, awaiting only a vote from SEC commissioners to formally dismiss remaining appeals.

A conditional settlement agreement previously signed by both parties failed to meet stipulated conditions, leaving appeals technically active. Market participants now watch August 15—the deadline for status updates to the U.S. Court of Appeals—as a potential resolution date.

The XRP community remains divided between cautious optimism and skepticism. While the court's procedural requirements maintain technical uncertainty, industry observers increasingly view the outcome as effectively determined in principle.

Ripple CLO Challenges SEC's Proposed Crypto Oversight in Senate Submission

Ripple's Chief Legal Officer Stuart Alderoty has formally opposed the U.S. Senate Banking Committee's proposed digital asset framework, warning it could perpetuate regulatory confusion. The draft legislation's expansive definition of "ancillary assets" risks granting the SEC indefinite jurisdiction over crypto transactions unrelated to securities offerings.

Alderoty cited Judge Analisa Torres' landmark ruling in SEC v. Ripple, which determined XRP sales on exchanges didn't constitute investment contracts. The legal chief advocates for a "safe harbor" provision to clarify when digital assets transition from securities to commodities—a move that could reshape crypto regulatory boundaries.

XRP Price Struggles Below $3 Amid Market Uncertainty

XRP's rally to a record $3.6 in mid-July proved short-lived as bearish pressure mounted. The token now faces stiff resistance at the $3 psychological level, recently sliding to $2.9 following large holder sell-offs.

Despite bullish catalysts including South Korea's BDACS endorsement and speculation about BlackRock's potential XRP ETF interest, the digital asset fails to gain upward traction. Ripple's strategic partnership with Japan's SBI Group similarly failed to ignite price momentum.

Market-wide risk aversion continues suppressing crypto valuations. XRP's 4% daily decline reflects broader sector weakness, with traders awaiting clearer signals for the next directional move.

XRP Faces Bearish Pressure as Traders Rotate into Alternative Altcoins

XRP's price action has turned decisively bearish, with the token struggling to maintain footing above $3. The cryptocurrency now hovers near $2.95, prompting concerns of a deeper correction toward $2—a level last seen in late June.

Technical indicators show a clear pattern of lower highs and lower lows across short-term timeframes. The $2.74 support level emerges as critical; a breach could accelerate losses. Meanwhile, capital appears to be migrating toward smaller altcoins like TOKEN6900, a new meme coin gaining traction during its presale phase.

The current sell-off reflects profit-taking after XRP's mid-July peak at $3.66, rather than fundamental deterioration. Yet the absence of bullish catalysts leaves the token vulnerable to further downside.

XRP Holders Shift Focus to Cloud Mining Amid Market Volatility

XRP investors are increasingly turning to blockchain cloud mining as an alternative to traditional trading strategies. The Blockchain Cloud Mining platform promises daily earnings of up to $3,777 without active market participation, appealing to those seeking stable returns in turbulent conditions.

Cloud mining emerges as a solution to the high-risk nature of conventional crypto profit methods like price speculation or DeFi participation. The platform offers instant sign-up bonuses and fee-free operations, positioning itself as a user-friendly alternative for XRP holders.

Is XRP a good investment?

XRP presents a high-risk, high-reward opportunity based on current metrics:

| Metric | Value | Implication |

|---|---|---|

| Price | 2.9748 USDT | Below 20-day MA (bearish) |

| MACD Histogram | +0.1657 | Positive momentum |

| Bollinger %B | ~0.5 | Neutral territory |

Key considerations include the SEC case resolution timeline, institutional adoption pace, and ability to hold above 2.7364 support. Dollar-cost averaging may mitigate volatility risks.